Excellent interview with Jim Rogers on the Bloomberg network. As usual, this guy has it right on. Watching his matter of fact manner against the desperation of the news anchors is the most entertaining part!

27.12.07

Unconventional Crude

Elizabeth Kolbert, A Reporter at Large, "Unconventional Crude," The New Yorker, November 12, 2007, p. 46

A REPORTER AT LARGE about extracting oil from the Alberta tar sands. The most important resource in the town of Fort McMurray, in northern Alberta, is the Alberta tar sands. The tar sands begin near the border of Saskatchewan and extend north and west almost to British Columbia...

20.12.07

Start-Up Sells Solar Panels at Lower-Than-Usual Cost

Keep an eye on these guys, coming soon to an IPO near you ;)

SAN JOSE, Calif. — Nanosolar, a heavily financed Silicon Valley start-up whose backers include Google’s co-founders, plans to announce Tuesday that it has begun selling its innovative solar panels, which are made using a technique that is being held out as the future of solar power manufacturing.

18.12.07

Zkullz

Amazon purchases J.K. Rowling's The Tales of Beedle the Bard for £1,950,000

The most expensive work of art ever created, Damien Hirst's For The Love Of God

H.P. Lovecraft exhibition poster by at-elier.net

Skull-A-Day Blog

Posted by

Save The Fails

at

8:40 PM

0

comments

![]()

Labels: amazon, damien hirst, fine art, h.p. lovecraft, j.k. rowling, madness, skull, skull-a-day

Sick Happy Fantasy World

Intelligent, hilarious, well drawn, and utterly morbid are the online comics comprising The Perry Bible Fellowship. Nicholas Gurewitch takes everyday situations and turns them on their head with a sense of humor that you may feel uneasy laughing along with. That too is part of the dark fun.

The Perry Bible Fellowship

Gopher Girlfriend - a favorite

How Goldman Won Big On Mortgage Meltdown

"The subprime-mortgage crisis has been a financial catastrophe for much of Wall Street. At Goldman Sachs Group Inc., thanks to a tiny group of traders, it has generated one of the biggest windfalls the securities industry has seen in years.The group's big bet that securities backed by risky home loans would fall in value generated nearly $4 billion of profits during the year ended Nov. 30, according to people familiar with the firm's finances. Those gains erased $1.5 billion to $2 billion of mortgage-related losses elsewhere in the firm. On Tuesday, despite a terrible November and some of the worst market conditions in decades, analysts expect Goldman to report record net annual income of more than $11 billion..." (full text posted on EliteTrader)

16.12.07

Bathing In It

The work of United Visual Artists is staggeringly large and wonderful, ranging from architecture to music video, installation to live VJing. All have have one thing in common: the use of light as a 2-dimensional object. Using custom built systems of LEDs these corporate artists create light-works which push the boundary of beauty and signification.

UVA website

UVA Blog - impressive images from their travels and behind the scenes development

Posted by

Save The Fails

at

7:01 PM

0

comments

![]()

Labels: fine art, installation, united visual artists

It.. Is.. Baby!

A series of clever Fanta commercials from Japan featuring increasingly stranger grade-school teachers. With the world gone mad, disillusioned youth can always escape into a world of chemically colored sugary goodness.

9.12.07

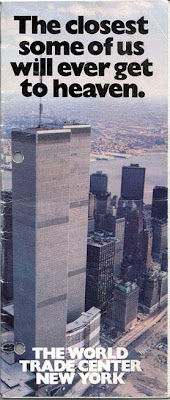

"A single seraphic word. You can examine the word with a click, tracing its origins, development, earliest known use, its passage between languages, and you can summon the word in Sanskrit, Greek, Latin and Arabic, in a thousand languages and dialects living and dead, and locate literary citations, and follow the word through the tunnelled underworld of its ancestral roots ...

"A single seraphic word. You can examine the word with a click, tracing its origins, development, earliest known use, its passage between languages, and you can summon the word in Sanskrit, Greek, Latin and Arabic, in a thousand languages and dialects living and dead, and locate literary citations, and follow the word through the tunnelled underworld of its ancestral roots ...

And you can glance out the window for a moment, distracted by the sound of small kids playing a made-up game in a neighbor's yard, some kind of kickball maybe, and they speak in your voice, or piggy-back races on the weedy lawn, and it's your voice you hear, essentially, under the Glimmerglass sky, and you look at the things in your room, offscreen, unwebbed, the tissued grain of the deskwood alive in light, the thick lived tenor of things, the argument of things to be seen and eaten, the apple core going sepia in the lunch tray, and the dense measure of experience in a random glance, the monk's candle reflected in the slope of the phone, hours marked in Roman numerals, and the glaze of the wax, and the curl of the braided wick, and the chipped rim of the mug that holds your yellow pencils, skewed all crazy, and the plied lives of the simplest surface, the slabbed butter melting on the crumbled bun, and the yellow of the yellow of the pencils, and you try to imagine the word on the screen becoming a thing in the world, taking all its meanings, its sense of serenities and contentments out into the streets somehow, its whisper of reconciliation, a word extending itself ever outward, the tone of agreement or treaty, the tone of repose, the sense of mollifying silence, the tone of hail and farewell, a word that carries the sunlit ardour of an object deep in drenching noon, the argument of binding touch, but it's only a sequence of pulses on a dullish screen and all it can do is make you pensive -- a word that spreads a longing through the raw sprawl of the city and out across the dreaming bourns and orchards to the solitary hills. Peace." -Don DeLillo, Underworld

Posted by

Space

at

6:52 PM

0

comments

![]()

Labels: 911, consciousness, don delillo, madness, world trade center

7.12.07

The Future While It's Still The Future

America's coming economic crisis. A look back from the election of 2016.

Space: Sorry, but i just don't buy it. It is too easy and fashionable to hop on board the american empire/dollar decline fan wagon. I don't know how or why, but the crowd is always wrong, it is practically immutable.

No Deal

"One drawback to many money management schemes is that they are wedded to the assumption of a logarithmic utility function. Essentially, this model assumes that the increase in people's utility for additional wealth remains constant for equal percentage increases in wealth. The problem with this model is that it is unbounded, eventually it will tell you to bet the ranch.

There is a technical objection to unbounded utility functions, which is known as the St. Petersburg Paradox. I can give the thrust of it with a simplified example. Suppose you have a billion dollars. If your utility function is unbounded, there has to be an amount of money that would have such a large utility that you would be willing to flip a coin for it against your entire billion-dollar net worth. There is no amount of money for which a sane person would gamble away a billion-dollar net worth on the flip of a coin..."

Who is the Artist?

Kutchner and Collaborator No. 58 Starry Night

Painter Steven R Kutchner turns the unconscious walks of bugs into what appear to be intentional artworks. The colors, chosen by Kutchner, are applied leg by leg to the insects and their small scale movements are captured as large scale gestures on the canvas.

5.12.07

Here Comes Santa Claus*

"The best time of the year is a 17-day stretch from December 21 to January 7. Over the last 111 years, the Dow has gained an average of 3.39% during that 17-day period.

"The best time of the year is a 17-day stretch from December 21 to January 7. Over the last 111 years, the Dow has gained an average of 3.39% during that 17-day period.

To put that in some perspective, the Dow’s annual gain is 8.32%. This means that more than 40% of the Dow’s yearly gain has come during this brief stretch which is less than 1/20 of the entire year..." (Crossing Wall Street)

image by antoine

To which of the following investors would mortgage-backed securities be most attractive?

You've got to appreciate the irony here. This is a question from the Canadian Security Course's (current) practice exam:

a. A young investor trying to build a portfolio.

b. A middle-aged investor concerned about retirement savings.

c. A senior with a large portfolio wishing to minimize taxes.

d. A senior needing income to augment a small pension.

You can leave your best guess in the comments.

4.12.07

A Little Bit of History Repeating

Having studied the stuff extensively I will be the first to admit that I'm a technical analysis skeptic, but as an open minded investor I can't help but notice an opportunity setting up in the U.S. equity indicies.

On December 11th the FOMC is due to make its rate policy decision, which many expect will involve an interest rate cut. The timing of this decision will correspond very nicely with what could be the completion of the technical pattern known as an 'inverse head and shoulders bottom'.

The same phenomenon took place on September 18th: a major sell-off, a wave of bearish sentiment, the formation of an inverse head and shoulders pattern followed by a huge rally on FOMC day that completed the 'pattern' with the break of the so called neck line.

Take it for what you will, but there is no doubt there are striking similarities in the price action and you can bet that a lot of technicians have their eye on this phenomenon. A break of the neck line before or on December 11th should send a lot of people piling back into equities. Whether or not this pattern will ultimately fail is anyones guess, but for the short term at least, it looks like Shirley Bassey was right.

The New Shelton Wet/Dry: The Oil Massage With No Happy Ending

"After burning through $185 million in 18 months, Boo.com ended the way it started: intoxicated by a dot-com pipe dream. Its bankruptcy marked the end of the ultimate parable of the new economy run amok — a tale filled with larger-than-life ambition, loads of hype, luxury living, a penchant for partying and, yes, a seemingly unlimited expense account..."

"After burning through $185 million in 18 months, Boo.com ended the way it started: intoxicated by a dot-com pipe dream. Its bankruptcy marked the end of the ultimate parable of the new economy run amok — a tale filled with larger-than-life ambition, loads of hype, luxury living, a penchant for partying and, yes, a seemingly unlimited expense account..."

2.12.07

The US Dollar Continued

I had suggested just over a week ago that the US Dollar might be in the process of bottoming out. One of the reasons I thought this was the particularly pessimistic cover of the Economist. Let me explain. The Economist is simply a specific incarnation of the extremely negative sentiment surrounding the U.S. dollar. Although I did discover that the Economist had suggested circa 2000 that commodities were going to be worthless forever (near the exact bottom in the commodities market) my main reason for this suggestion was to be a contrarian. When everyone is on the same side of a market, whether it is stocks, gold, wheat, or Google, that market becomes very vulnerable to moves in the other direction for the simple reason that there is not really anyone left to buy (or sell in this case) and a whole lot of people sitting on profits (short sale profits count too).

I had suggested just over a week ago that the US Dollar might be in the process of bottoming out. One of the reasons I thought this was the particularly pessimistic cover of the Economist. Let me explain. The Economist is simply a specific incarnation of the extremely negative sentiment surrounding the U.S. dollar. Although I did discover that the Economist had suggested circa 2000 that commodities were going to be worthless forever (near the exact bottom in the commodities market) my main reason for this suggestion was to be a contrarian. When everyone is on the same side of a market, whether it is stocks, gold, wheat, or Google, that market becomes very vulnerable to moves in the other direction for the simple reason that there is not really anyone left to buy (or sell in this case) and a whole lot of people sitting on profits (short sale profits count too).

The reason I bring all of this up, is that a second factor speculators look for has come into play in the USD: new bearish news has been unable to push the price to new lows. This week the markets decided that its significantly more likely that the Federal Reserve is going to cut interest rates when it meets in December. This news, especially in light of all of the dollar collapse and currency diversification talk, should have sent the USD reeling, or hitting new lows at the very least, but take a look at the chart, not only did the dollar not make new lows, it challenged the highs of the previous week:

Of course there are still a whole lot of people out there with Dollars to sell that could just decimate the thing. Maybe they are waiting for more attractive prices, or maybe the economic tides are turning and this could be a real bottom, nobody knows for certain. What is for certain is that there are two excellent indicators staring us in the face, so perhaps its time to test the waters.

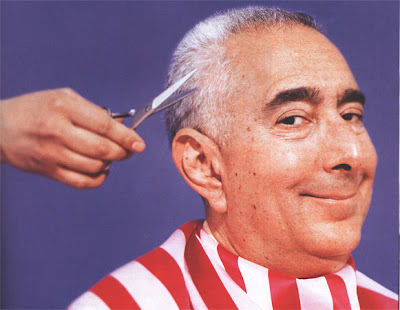

The Urban Peasant Passes On

CBC Radio just reported that James Barber has died. This is sad news for anyone who grew up watching his wonderful, laid back style of cooking that espoused using no measuring utensils, and whatever you could find in the bottom of the fridge. CBC reports that at the time of his death he was sitting at his kitchen table with a pot of soup on the stove.

Posted by

Space

at

10:07 AM

0

comments

![]()

Labels: consciousness, cooking, james barber, the urban peasant

Rare Mummified Dinosaur Unearthed: Contains Skin, and Maybe Organs, Muscle

1.12.07

Stunning Meomi

It’s better because you don’t even have to roll down the windows

A new biker gang is roaming the streets of Queen's. Strapped to the bikes of urban youth are huge speaks which put out 5, 000 watts of sound to the neighbourhood.

More Photos/Video/Story (NY TIMES)

via the new shelton wet/dry

30.11.07

Chip Shot

This weeks market action reminds me of a passage from the very excellent New Market Wizards:

“On that day, I spoke to Paul Tudor Jones, who had just returned from participating in a round table discussion sponsored by Barron's. He told me that eight out of the eight participating money managers had said they were holding their highest cash position in ten years. I'll never forget that the S&P was near 310 and Paul said, “340 is a chip shot.”

As of Friday at Noon the S&P is up 5.5% from Monday's close.

29.11.07

ACT-R

Act-R is a complicated and fascinating thoery of human cognition. The Carnegie Mellon University website has a series of tutorials on the subject as well as an excellent overview of the theory.

"ACT-R is a cognitive architecture: a theory about how human cognition works. On the exterior, ACT-R looks like a programming language; however, its constructs reflect assumptions about human cognition. These assumptions are based on numerous facts derived from psychology experiments."

27.11.07

Simons at Renaissance Cracks Code, Doubling Assets

26.11.07

The Macroeconomics of Going Green

I think a dream scenario is unfolding for clean energy stocks in the United States. Here's why:

The mortgage meltdown is great news for clean energy. Thanks to lower interest rates the young companies that make up the majority of this sector have access to cheap capital for research and development and to expand their operations. These same low interest rates devalue the USD and raise the cost of energy for Americans, creating incentives to seek out alternate sources of fuel.

Owning clean energy stocks functions as a hedge against an oil shock scenario. If things turn ugly in the middle east and oil goes Ahamadinejad, speculative money will start flowing into this sector and offset at least some of the market risk.

Betting website Intrade.com gives the Democrats 65% odds of winning the next presidential election, and Hillary 70% odds of being the Democratic nominee – Hilary has a husband who has an ex. business partner who has a Nobel Prize...

The scale of transformation that will take place has not been seen since the industrial revolution. You thought dot com was big? You think China is big? Well guess what: this will be bigger. Imagine a scenario in which nearly every government, corporation and individual in the world makes significant changes to every aspect of their daily lives.

Jim Rogers talks about how, at the turn of the century, when everyone was talking about dot com stocks, he was looking at commodities and China. Now its 2007. Everyone is looking at commodities and China. Where are you looking?

The trick here will be not to select individual companies, because the fortunes of any one of these 5 or 10 years out is entirely unpredictable. Instead make a play on the theme. PBW, PBD...buy them all and hold on for the ride. It's a bet that will be difficult to lose.

What Really Happened to Long Term Capital Management

"Rarely in the course of human events have so few people lost so much money so quickly..."

Posted by

Space

at

6:34 AM

0

comments

![]()

Labels: finance, hedge fund, long term capital management, ltcm

Econbrowser: Oil and the Dollar

"The dollar falls and oil prices go up. So the two must be related, right?..."

25.11.07

This morning i woke up with a sore throat - Reed Barrow

Posted by

Save The Fails

at

4:07 PM

0

comments

![]()

Labels: art, dreamcatcher, installation, Reed Barrow, werewolf

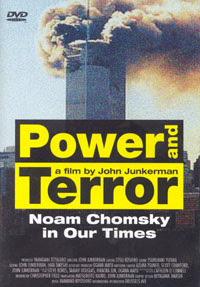

Power and Terror: Noam Chomsky in Our Times

Scale: Glaciers in Africa & Underground Experiments

Listen to audio slideshows by photographer Simon Norfolk speaking about bringing an 8x10 camera up Kilimanjaro, capturing images of the LHC, and more.

Posted by

Save The Fails

at

12:09 PM

0

comments

![]()

Labels: glaciers, kilimanjaro, large format photography

23.11.07

Physorg: Researchers Create Robot Driven by Moth's Brain

BoingBoing: Hawala, an ancient global financial honor-system

"Hawala is a money-transfer system based primarily in Asia, Africa and the Middle East, based on independent brokers who phone one another and say, "I'm holding so much money in such and such a currency, please transfer an equivalent sum in local funds to such and such a person." The settlements are based on the honor system, and by some accounts, the network has its origins in the Silk Road. The system functions even in places where the rule of law and other elements normally considered crucial to a a functional financial system have collapsed..."(boingboing)

21.11.07

The Taugshow

"Friday, November 23, 2007 / 8:00 PM @ Brut, Konzerthaus, Vienna

The flat hierarchies of talk shows are about as subversive as NYC Democrats smoking dope. But count us out! We won't produce a talk show. Nope. We produce a TAUGSHOW! Which means: we dig it. Our guests are geeks, heretics, and other coevals. A joyful bucket full of good clean fanaticism, crisis, language, culture, self-content, identity, utopia, mania and despair, condensed into the well known cultural technique of a prime time TV show..."(monochrom)

Has the USD hit rock bottom?

The USD bottom arrived in the mail today in the form of the cover of the Economist. Like the pundits exclaiming gold was headed to 2000 per ounce in May 06 (it may well be, but in the intermediate term at least, that signaled the top of the move) I think this could be a strong sign that we are oversold at these levels. When super-models, rappers, magazines and dictators are all at once signaling the imminent demise of the USD, it makes you start to wonder....I'm thinking mean reversion at the very least.

The Country Club, Revisited

The Globe and Mail has an interesting article on The Private Collection, a Toronto-based car "club". For a $5k charge + $31k/year, members get the opportunity to time-share a stable of automobiles which includes a Ferrari F430, a Lamborghini Gallardo, and a Porsche Cayman S.

It sounds like a fun idea; given the right business partners I'd be quite willing to try it in another major center. In order to reduce the risks associated with giving potentially inexperienced drivers supercars to drive on public roads, I would require the club members to assume liability for the car and any damage they may cause with it -- thereby forcing them to think twice before they test 0-200 times on the nearest on-ramp.

Also, take some time to read the comments: it would seem that a majority of posters echo the sentiments of one colorful commenter, who derided the club's members as "Urban a$$holes looking to let 'er rip...". A bit presumptuous, I think. (One poster went as far as to write, "I couldn't care less if you crash your expensive toy. But what about the wildlife that you threaten?" After all, a great deal of wildlife is killed each year by investment bankers driving $300k Ferraris.)

Freddie, Fannie Shares Will Continue to Slide, Jim Rogers Says

"Nov. 20 (Bloomberg) -- Freddie Mac, which today dropped the most ever after posting a record loss, and rival mortgage lender Fannie Mae will continue to tumble because of bad home loans, investor Jim Rogers said.

``I'm still short those companies, they both have a long way to go as far as I'm concerned,'' Rogers said in an interview. ``Neither one has a clue what's on their balance sheets.''..."(Bloomberg)

20.11.07

"Incredible Silhouettes of patrons at the American Museum of Natural History by NYC photographer Joe Holmes." (kottke)

19.11.07

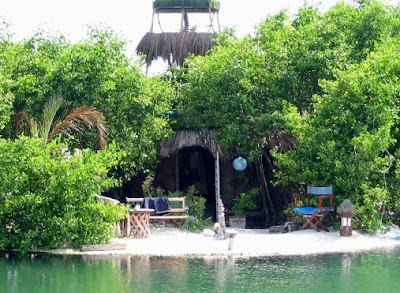

Mexican Island made of Recycled Floating Bottles

Mexican Island made of Recycled Floating Bottles (youtube)

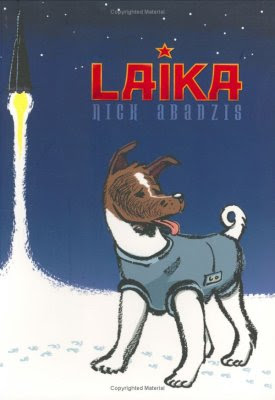

Laika

"Nick Abadzis's graphic novel "Laika" is a haunting, sweet biography of Laika, the first dog in space, who died five hours after she was launched on Sputnik II. Laika was a victim of the political vicissitudes of the Kruschev regime and its desire to push the propaganda war against the USA by elaborating on the triumph of Sputnik by launching a living organism into space." (boingboing)

17.11.07

Strange Loops

How do financial markets influence the blogosphere? How does the blogosphere influence financial markets? I lined up some S&P500 charts with outputs from the Nielsen Buzzmetrics BlogPulse Tool.

F-35 Joint Striker Fighter helmet renders the plane nearly invisible

"This ain't your papa's flight helmet. Designed for pilots of the F-35 Joint Strike Fighter, the helmet you see above will allow pilots to virtually see through the aircraft around them, giving them a wide field of view ahead and superimposing an Infared image of the world below onto their visors at night."

16.11.07

Children of the Cave

"Children attend class at the Dongzhong (literally meaning "in cave") primary school at a Miao village in Ziyun county, southwest China's Guizhou province, November 14, 2007. The school is built in a huge, aircraft hanger-sized natural cave, carved out of a mountain over thousands of years by wind, water and seismic shifts." (Reuters)

Video Game or Interactive Music Video?

The enjoyment of Transmigration doesn't come from shooting things (your guns always find their target) or winning (collisions don't seem to matter) but the interplay between the scenarios, the music, and your limited interaction with both.

15.11.07

An Exceptionally Simple Theory of Everything by Garrett Lisi

Surfer dude (with a ton of degrees) stuns physicists with geometrical theory of everything