20.2.08

14.2.08

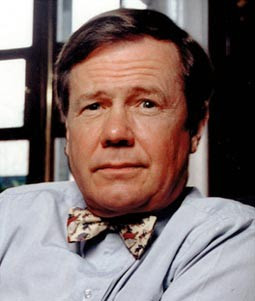

Do You Believe In America Yet?

Thanks Web 2.0. Thanks new millenium. Thanks hyper-conscious superstars. Thanks for the striking contrast between old and new.

(p.s. Can you spot the Canadian?)

12.2.08

You Are (barely) Alive!

The Japanese artist Takashi Murakami certainly has a rainbow coloured imagination, but who knew he had feelings too? The ironic, desperate kind, the frustration-of-being kind. Not to mention the subversion of advertising within the confined framework of a commercial. It is usually that longing is fulfilled within these contexts, that desire can be overcome and its goal reached. Not here. But more importantly, outside of the localized capitalist motif, these commercials give us a unique insight into how an artificial creature, bestowed with the same neuro-curcuitry and consciousness as us, would be stuck living a life of longing and resentment. The brain is only half the battle.

(via Kitsune Noir)

Posted by

Save The Fails

at

9:20 AM

0

comments

![]()

Labels: art, artificial intelligence, consciousness, takashi murakami

3.2.08

The Reality of the Virtual

Brain-Computer Interface for Second Life

"A research team at the Keio University Biomedical Engineering Laboratory has developed a system that lets the user walk an avatar through the streets of Second Life while relying solely on the power of thought. An EEG machine reads motor cortex data and relays it to the BCI, where a brain wave analysis algorithm interprets the user’s imagined movements. A keyboard emulator then converts this data into a signal and relays it to Second Life, causing the on-screen avatar to move."

(more via Pink Tentacle)

"Virtual Reality is a rather miserable idea. A much more interesting notion is the opposite. Not virtual reality, but the reality of the virtual. That is to say reality, real effects produced by something that does not yet fully exist." Slavoj Žižek - The Reality of the Virtual

Posted by

Save The Fails

at

6:57 PM

0

comments

![]()

Labels: consciousness, madness, second life, virtual reality, zizek

2.2.08

'It's going to be much worse'

NEW YORK (Fortune) -- You might expect Jim Rogers to be gloating a little bit. After all, the famed investor has been predicting a recession in the U.S. economy for months and shorting the shares of now-tanking Wall Street investment banks for even longer. And with fears of a recession sparking both a worldwide market sell-off and emergency action from Federal Reserve chairman Ben Bernanke, Rogers again looks prescient - just as he has over the past few years as the China-driven commodities boom he predicted almost a decade ago began kicked into high gear. But when I reached him by phone in Singapore the other day there was little hint of celebration in his voice. Instead, he took a serious tone.

27.1.08

Bank's billions burnt in 10 days

By Friday, January 18, Jérôme Kerviel, a junior suit in the banking world, was on the hook for €50 billion - the equivalent of about half of all the gold and currency reserves held by France. The sum also exceeded the entire value of the bank at which he worked...

19.1.08

Robot Controlled by Monkey Across the Sea

"A humanoid robot moves its legs at a laboratory in Japan as directed by the brain waves of a small monkey located in the United States." - Discovery News (thanks Heather!)

16.1.08

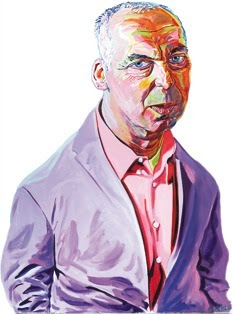

The Blow-Up Artist

Excellent article about Victor Niederhoffer in the New Yorker. I cannot recommend this strongly enough.

"On a wall opposite Victor Niederhoffer’s desk is a large painting of the Essex, a Nantucket whaling ship that sank in the South Pacific in 1820, after being attacked by a giant sperm whale, and that later served as the inspiration for “Moby-Dick.” The Essex’s captain, George Pollard, Jr., survived, and persuaded his financial backers to give him another ship, but he sailed it for little more than a year before it foundered on a coral reef. Pollard was ruined, and he ended his days as a night watchman. The painting, which Niederhoffer, a sixty-three-year-old hedge-fund manager, acquired after losing all his clients’ money—and a good deal of his own—in the Thai stock market crash of 1997, serves as an admonition against the incaution to which he, a notorious risktaker, is prone, and as a reminder of the precariousness of his success..."

You can check out Neiderhoffer's website at dailyspeculations.com